Supreme Court Order Response: Dr. Nowhera Shaik’s Commitment to Investor Justice

Dr. Shaik’s Initial Response

Supreme Court Order Response: Dr. Nowhera Shaik’s Commitment to Investor Justice, In a notable development, Dr. Nowhera Shaik, the leader of Heera Group, has publicly expressed her willingness to comply with the Supreme Court’s recent directive. This response marks a significant step in the ongoing legal proceedings surrounding the Heera Group and its investors.

Dr. Shaik stated her readiness to surrender to the designated government agency within the specified two-week period, demonstrating respect for the court’s decision. This move highlights the Heera Group’s intention to cooperate with legal authorities and work towards a resolution that prioritizes the interests of their investors.

Table of Contents

In her public statements, Dr. Shaik made several key points to reassure investors and outline the Heera Group’s intentions:

- Commitment to Investor Justice: “Heera Group is always ready to settle the amount to the clients, and I am always ready to do justice to their investors,” Dr. Shaik affirmed. This statement underscores her dedication to addressing the concerns of the group’s clientele.

- Formation of Oversight Committees: To ensure transparency during her custody, Dr. Shaik announced the establishment of committees. These groups will be tasked with overseeing the financial accounts of the Heera Group, providing an additional layer of accountability.

- Encouraging Investor Participation: Dr. Shaik urged investors to actively participate in the liquidation process. This participation would be in line with the directives of the Supreme Court and government agencies following her surrender.

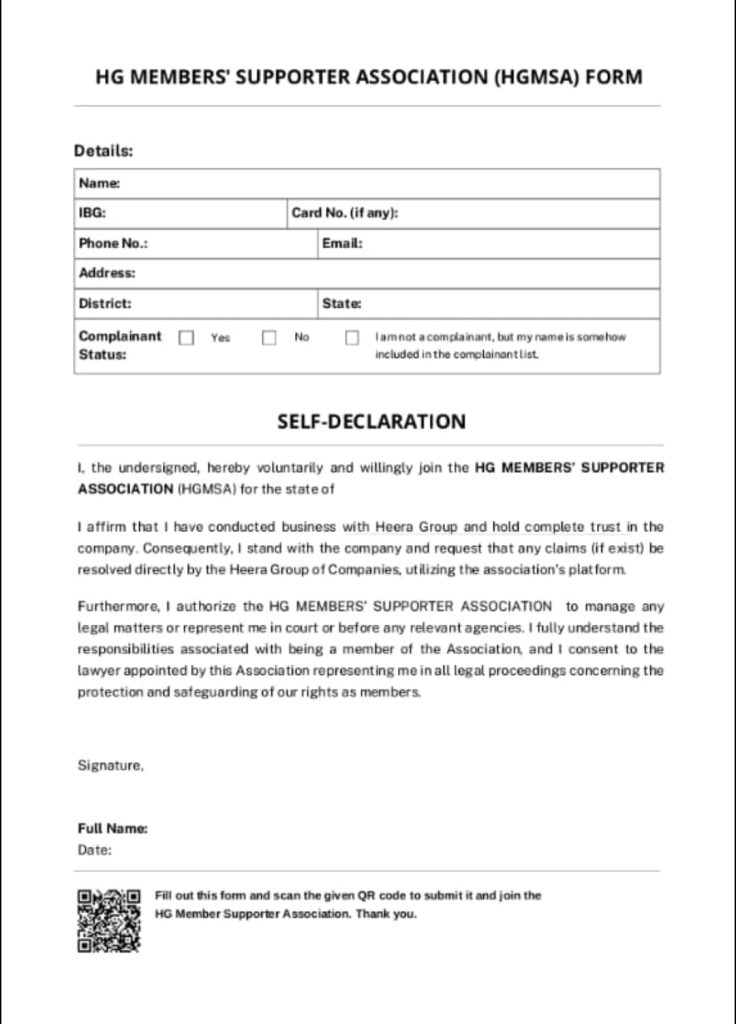

To facilitate this process, the Heera Group has set up a platform for investors to register their claims. Interested parties can submit their details through the HG MEMBERS’ SUPPORTER ASSOCIATION (HGMSA) .

Challenges Facing Heera Group

While Dr. Shaik and the Heera Group have expressed their commitment to complying with the Supreme Court’s order, they face significant challenges in meeting the court’s deadline for depositing INR 580 crores. These obstacles include:

- Account Freezing: All Heera Group accounts are currently frozen, severely limiting the company’s access to funds that could be used to settle investor claims.

- Asset Possession by Government Agencies: The Enforcement Directorate (ED) has taken possession of Heera Group’s assets. This action complicates the group’s ability to leverage these properties for raising the necessary funds.

- Encroachment Issues: Several properties owned by the Heera Group are facing encroachment by squatters. This situation has led to legal and logistical difficulties in liquidating these assets.

- Lack of Suitable Bids: Finding appropriate buyers for the group’s properties has proven challenging, further delaying the liquidation process required for raising the court-mandated amount.

These obstacles have significantly delayed the Heera Group’s efforts to comply with the Supreme Court’s directive, causing distress among investors who have been awaiting the settlement of their claims. Despite these hurdles, Dr. Shaik has expressed regret for the delays and emphasized the group’s ongoing commitment to resolving the matter.

Formation of Investor Association

In a proactive step to support investors, an association is being formed for all Heera Group investors. This association aims to provide backing to the company and safeguard investor interests, particularly in the event that Heera Group properties are subjected to liquidation.

The association’s role becomes crucial in ensuring that investors receive their due shares from the liquidation proceeds. With 110 properties currently under consideration, including one with a market value of INR 600 crore, the association’s involvement is critical in protecting investor interests.

To join this effort, investors are required to fill out a form and submit one of the following documents:

- A membership certificate or other relevant proof of association

- A bank statement reflecting any investment in Heera Group

- A copy of any upper certificate related to investments

Investors can complete this process by scanning a QR code provided by the Heera Group. Importantly, the company has clarified that no costs will be incurred by investors for participating in this association. The Heera Group has committed to providing the association with legal support and guidance, ensuring that investors are well-represented in the ongoing settlement processes.

Settlement Plans for Investors

Despite the numerous challenges faced, the Heera Group remains committed to settling the claims of investors. Dr. Nowhera Shaik has assured that all investors will receive their rightful dues without further delay, in line with the Supreme Court’s orders.

The settlement plan outlined by the Heera Group includes the following key steps:

- Asset Liquidation: Following the conclusion of the trial in the Supreme Court, all Heera Group properties will be sold off to repay investors. This process is being closely monitored by legal authorities to ensure fairness.

- Surety Arrangement: A 120-crore property is being proposed as surety against the INR 580 crore that the Supreme Court has demanded. This arrangement is designed to secure the interests of investors during the liquidation process.

- Commitment to Justice: Dr. Shaik has pledged that regardless of her personal situation, the Heera Group will continue to focus on delivering justice to its investors, demonstrating a long-term commitment to transparency and fairness.

Heera Group’s Assets and Repayment Strategy

The Heera Group has emphasized that it possesses substantial assets dedicated to the repayment of investors. The company owns between 90 and 120 prime properties that are earmarked specifically for settling investor claims. These properties represent a significant source of value, which the group plans to unlock through the liquidation process.

Even in the face of legal challenges and the possible outcome of Dr. Shaik’s custody, the Heera Group has maintained its focus on investor justice. Dr. Shaik, through a recent video announcement shared on social media platforms, reiterated the group’s commitment to its clients, stating that the work towards investor repayment will continue unabated.

The group’s strategy for repayment involves:

- Property Valuation: Conducting thorough assessments of all properties to determine their current market value.

- Prioritized Liquidation: Identifying properties that can be sold quickly without significant loss of value.

- Transparent Distribution: Ensuring that the proceeds from property sales are distributed fairly among investors, in accordance with their investment amounts.

- Regular Updates: Committing to provide regular updates to investors about the progress of the liquidation and repayment process.

Moving Forward: Hope for Resolution

The situation surrounding the Heera Group and its investors is complex, marked by legal battles, asset liquidation processes, and the establishment of an investor association. However, the steps being taken by both the Heera Group and the Supreme Court indicate a concerted effort to bring about a resolution that prioritizes the interests of the investors.

While challenges remain, the commitment of Dr. Nowhera Shaik to cooperate with legal directives, coupled with the formation of the investor association, provides a structured path forward. Investors are encouraged to:

- Stay engaged with the process

- Submit their claims through the official channels

- Take advantage of the support mechanisms being put in place, such as the investor association

The Heera Group’s dedication to transparency and investor justice, even amidst significant legal hurdles, offers hope for a positive outcome in this long-standing dispute. With the collective efforts of all parties involved, the goal remains clear: to ensure that investors receive their rightful dues and that the integrity of the process is maintained throughout.

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. Investors are advised to seek professional guidance regarding their specific situations.